August 2022 Newsletter

Message from the Registrar

Kia ora koutou

This has been a busy month for the Authority, as we have entered a peak time for the submission of initial and upgrade licence applications. Without a doubt, with the full reopening of New Zealand’s borders, this has also been a busy month for the immigration advisers’ industry.

As part of our efforts to assist and guide advisers on maintaining Code-compliant practices, we presented our second webinar for the year, ‘The Client Relationship (Part 2)’. The webinar was delivered on 25 August, and focused on issues commonly experienced after the initial client engagement, as highlighted by the results of the 2021 Migrant Survey. Our guest speaker, licensed immigration adviser David Cooper, shared his thoughts on managing a busy practice. We trust that many advisers will benefit by learning from his experiences. If you were unable to join this webinar, you are welcome to watch a recording, details are available below. We have also included answers to some of the questions we were unable to address during the live event.

Results of the 2021 Migrant Survey

In this newsletter, we have also included licensing and complaints statistics for the 2021/22 financial year, which may be of interest to many of you.

Kia kaha and keep our standards high.

Duncan Connor

Registrar of Immigration Advisers

A Year in Numbers (2021-2022)

Licensing and complaints statistics for 2021-2022 financial year

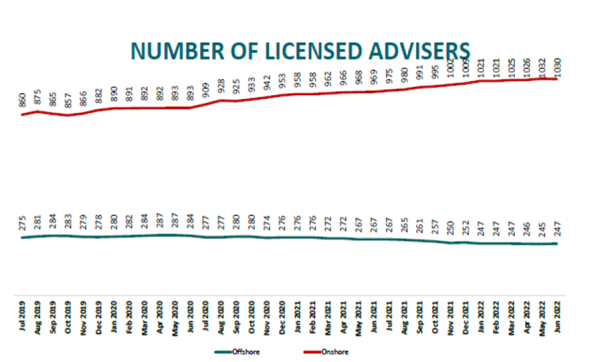

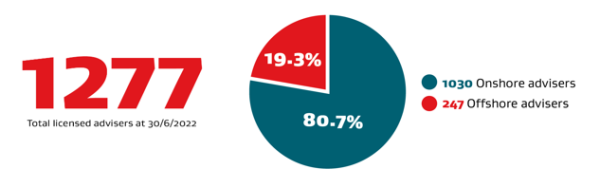

There has been a slight increase in the total number of licensed advisers: from 1238 on 30 June 2021 to 1277 on 30 June 2022:

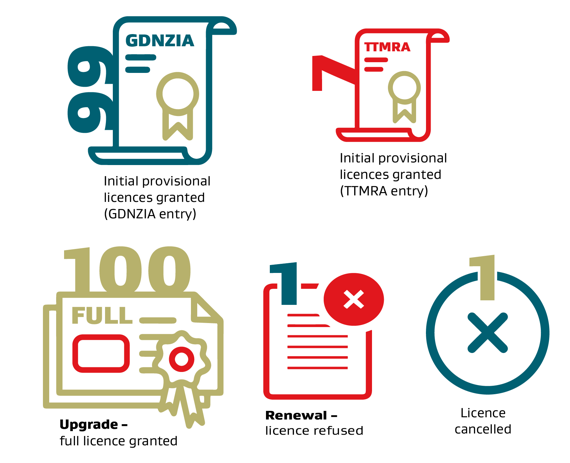

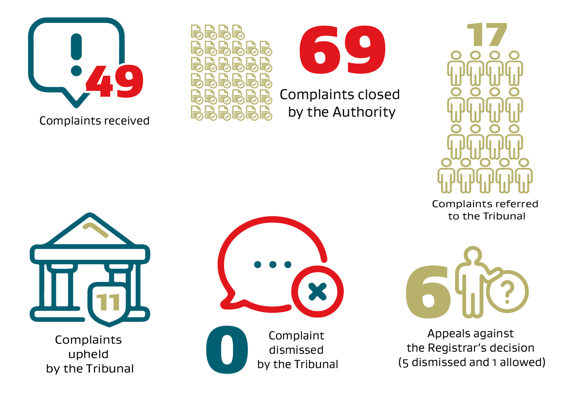

The figures below refer to the period 1 July 2021 – 30 June 2022:

Licensing application outcomes

Complaints against licensed advisers

Unlicensed persons

A year in numbers (2021-2022) text

Licensing and complaints statistics for 2021-2022 financial year

There has been a slight increase in the total number of licensed advisers: from 1238 on 30 June 2021 to 1277 on 30 June 2022.

Number of licensed advisers

1277 total licensed advisers as at 30/06/2022

1030 onshore advisers (80.7%)

247 offshore advisers (19.3 %)

The figures below refer to the period 1 July 2021 – 30 June 2022:

Licensing application outcomes

99 Initial provisional licences granted (GDNZIA entry)

7 Initial provisional licences granted (TTMRA entry)

100 Upgrade applications – full licence granted

1 Renewal application refused

1 Licence cancelled

Complaints against licensed advisers

49 Complaints received

69 Complaints closed by the Authority

17 Complaints referred to the Tribunal

11 Complaints upheld by the Tribunal

0 Complaints dismissed by the Tribunal

6 Appeals against Registrar’s decisions (5 dismissed and 1 allowed)

Unlicensed persons

39 Complaints received

46 Complaints closed

3 Prosecutions

Licensing Matters

Updated and new resources

While inspecting CPD records and client files, we frequently come across two common issues:

- Advisers failing to attach evidence of attendance (verification records) to their CPD plan and record;

- Client files containing written agreements, which are not fully compliant with Clause 19 of the Code of Conduct 2014 (the Code).

Code of Conduct 2014

Therefore, we have updated our CPD plan and records template to remind advisers that they must submit documentation which verifies their participation in each claimed CPD activity.

CPD plan and records template [PDF, 147 KB]

We have also uploaded a checklist for advisers, which aims to assist them in developing a compliant written agreement.

Please visit the Code of Conduct Toolkit: Content of Written Agreements

You can access the checklist here:

Written agreement – Guidance and checklist for licensed advisers [PDF, 184 KB]

IAA Webinar 2

The recording of our second webinar, ‘The Client Relationship (Part 2)’ is now available to view. We have also provided a PDF version of the presentation for you to download. You can access both of them on our Webinar page.

Q & A session: Answers to anonymous questions

There were many questions submitted during the webinar, but due to time constraints we could not specifically answer them. We are in the process of reaching out to advisers whose questions remained unanswered. Our responses to relevant questions posed anonymously, appear below.

These cover various aspects of Code of Conduct 2014 (the Code)

1. Can the IAA also put some effort into stopping education personnel from helping students with their visa applications?

Under section 11(h) of the Immigration Advisers Licensing Act 2007, persons who provide immigration advice offshore with respect to student visa applications, are exempt from the requirement to be licensed.

Section 11(h) of the Immigration Advisers Licensing Act 2007(external link) – Legislation New Zealand

However, if the advice on student visa applications is provided onshore, then the individual providing such advice must be licensed, as per Section 6 of the Act. The Authority continues to investigate and prosecute individuals providing unlicensed advice.

Section 6 of the Immigration Advisers Licensing Act 2007(external link) – Legislation New Zealand

You can read about an example of this kind of prosecution here

Education agent pleads guilty to four charges of unlawful immigration advice

Therefore, if you are aware of such unlawful activities, we encourage you to submit a complaint to the Authority, so that it can be investigated.

Submit a complaint to the Authority(external link)

In addition, the investigation team has regularly run proactive educational campaigns by visiting education agents and advising them of the limits of immigration advice.

2. Regarding fees, it is unclear anywhere on fee policy what it means to be reasonable fees. I believe, there must be a minimum fee set out by the Authority across the board for every type of visa or services an LIA offers?

The professional service fee will depend on the presence of several factors, including the individual circumstances of your client. A mandatory set fee will not necessarily take these factors into account and might therefore not be a fair reflection of the value of the services you provide to your client. Nonetheless, we have listed some tips on setting a fair and reasonable fee in the Code of Conduct Toolkit on our website.

See also, the Tribunal’s decision in Chen v Loh [2013] NZIACDT 15 [PDF 218KB](external link) – Ministry of Justice

3. For any change in terms of agreement, does a fresh agreement need to be sent?

It is not necessary to draft a new agreement; however, you must ensure that the changes are recorded and accepted in writing by all parties, as stated in Clause 18(d) of the Code.

For further information, please visit the Code of Conduct Toolkit

4. If I have a two step fee structure, but don’t actually take the money out of client account until after both steps of service are completed, is that an issue for IAA?

The Code does not specify a timeframe within which payable amounts may be withdrawn from the client account. From the provisions of Clauses 25(a)-(b) and (e) we know that the money held in a client account is being held on behalf of the client and remains their property until they receive an invoice telling them that the money is now payable to the adviser: Only then can the money be withdrawn from the client account. With respect to mixed funds, i.e funds deposited into the client account from the outset, but which include both payable payments and advance payments, Clause 25(c) of the Code of Conduct states that the portion of the funds which is payable, and for which an invoice has been issued, must be withdrawn from the practice account ‘as soon as [it is] practical’ to do so. Lastly, Clause 25(f) of the Code provides that that the funds may only be used for the purpose for which they were paid to the adviser. The Code of Conduct Toolkit elaborates on that provision by pointing out that that the client account should not be used to hold money for the purpose of earning interest.

Professional practice - Clauses 25(a)-(b) and (e)

What is ‘practical’ depends on the facts and circumstances of each case.

Therefore, the practice may be contrary to Clause 25 of the Code, if the adviser is not withdrawing the money as soon as it is practical to do so and is keeping the funds in the client account for purposes of earning interest (for example).

This is only a general observation, based on the provisions of Clause 25 of the Code. We encourage you to seek legal advice if you remain unsure whether your specific business practice is in line with the Code.

5. Visa application fees, if put in clients’ account can be an issue as they are money that are not for the LIA but for INZ. This is especially in regards to the anti-money laundering law. Is it not best to have a bank account just for visa application fees?

6. For INZ fee received in advance, can it be used to pay INZ fee of the client? As the invoice will only be raised after payment of INZ fee. We had discussion in our CPD and there were different opinions. Though, it is advised that AML law allows this.

Our answer to both questions appears below.

You can receive funds in advance and place them in a client account for purposes of paying an INZ application fee (being a disbursement), provided that:

- This is clearly set out in the written agreement with your client;

- The money is only used for the reason for which it was received (i.e payment of the INZ fee);

- You pay the INZ fee on behalf of your client;

- You invoice the client for the INZ fee paid;

- You then transfer the corresponding amount from the client account into your business/practice account.

As always, please bear in mind that under Clause 3 of the Code of Conduct 2014, a licensed immigration adviser must,

- if operating in New Zealand, act in accordance with New Zealand law

- if operating offshore, act in accordance with the law of the jurisdiction they are operating in […]

For further information and advice, please contact Te Tari Taiwhenua | Department of Internal Affairs and seek legal advice if you remain unsure whether your business practice is in line with local law.

Te Tari Taiwhenua(external link) – Department of Internal Affairs

7. How does an adviser deal with a difficult former or current client, who just doesn’t understand the engagement process and their part of the obligations under the arrangement and then goes on to defame the advisers and their business on social media?

You must communicate clearly with your client from the start and comply with all Code requirements related to client care . This would go a long way towards ensuring that there is no misunderstanding between you and your client.

We would recommend that you watch our first webinar ‘The Start of the Client Relationship’, if you have not done so already. A recording is available on our website.

8. Can we not invoice a certain percentage of the total fees after signing the Agreement that is before any work commences? Because if we don't, client may withdraw before we even issue an invoice and runs away...

The short answer is that you may not invoice your client for work you have not yet done.

Clause 22 of the Code provides:

A licensed immigration adviser must, each time a fee and/or disbursement is payable, provide the client with an invoice containing a full description of the services the fee relates to and/or disbursements that the invoice relates to.

A service fee is due and payable only once the work that the fee relates to has been completed. If the client wishes to withdraw before work has commenced, there would be no reason to issue an invoice. If you have provided services, invoiced your client accordingly, and the client fails to pay the fee that is due, you will have to rely on the ordinary remedies available under the law of contract.

Clause 22 is also applicable in cases where the adviser receives funds in advance.

If you wish to receive funds in advance prior to work being completed or disbursements incurred, you must have a separate client account and a practice account, as per Clause 25 of the Code.

You will have entered into a written agreement with your client, setting out payment milestones for agreed blocks of work, as required by Clause 19(i) of the Code. From the written agreement, it should be clear to the client that they will have to deposit an X amount into a specified client account. As soon as you complete the first block of work, you must issue an invoice clearly describing the work completed. Thereafter you are entitled to transfer the funds into your practice account because the funds are payable.

For further information, please visit the Code of Conduct Toolkit

and

Tribunal Decisions

Immigration Adviser has licence cancelled after deceiving client

Ying Tian, also known as Tina Qin and Ying Qin, has had her immigration advisers licence cancelled and has been ordered to pay $35,145 in penalties and compensation after the Immigration Advisers Complaints and Disciplinary Tribunal upheld a complaint against her. The Tribunal also censured Ms Tian and prohibited her from reapplying for any licence for two years. In decision TA v Tian [2022] NZIACDT 19 the Tribunal found that between 2015 and 2021 Ms Tian lodged multiple unsuccessful visa applications for a client, and for a prolonged period claimed to be working on visa applications for the client but in reality was not undertaking any work on their behalf. The Tribunal found Ms Tian to be in breach of multiple clauses of the Licensed Immigration Advisers Code of Conduct and that her actions were dishonest and deceptive. This was the fourth complaint upheld by the Tribunal against Ms Tian.

Are ancillary services considered immigration advice?

The Immigration Advisers Complaints and Disciplinary Tribunal has recently released two decisions that address whether ancillary services by licensed immigration advisers, such as NZQA assessments and tax residence work, are considered immigration advice and covered by the Immigration Advisers Licensing Act 2007 and Code of Conduct.

In LS v Murthy [2022] NZIACDT 5 the Tribunal found that a NZQA assessment of a migrant’s qualifications fell under the definition of immigration advice:

…it is unrealistic to sever the NZQA assessment from the EOI/residence visa work. The EOI/residence work clearly falls within “immigration advice” as defined. It is appreciated that such an assessment is not necessary for an EOI and that clients often deal with NZQA themselves. However, the assessment was indisputably necessary for the residence visa… Ms Murthy’s work on the NZQA assessment was “immigration advice”…

In GZ v The Registrar of Immigration Advisers [2022] NZIACDT 16 the Tribunal found that tax residence work for a migrant fell under the definition of immigration advice:

… the agreement of 15 November 2019, while intended by the adviser to concern tax services, was in reality the first stage of an immigration visa. That was the objective of the taxation services and ultimately of the agreement. That much is plain from the face of the agreement. It is therefore clearly within the regulated services captured by the statutory definition of “immigration advice”. The adviser was accordingly required to comply with all the Code obligations relating to entering into agreements for immigration services...

New decisions are appearing regularly, and I encourage you to save the following link as a bookmark.

Read recent Tribunal decisions(external link) – Ministry of Justice

Gravitas Migrant Survey (2022/2023)

Visa applicant survey to begin early October

The first part of the 2022/2023 financial year survey of visa applicants who have used a licensed immigration adviser will be conducted during October 2022. Subsequent surveys will be conducted in January, April and July 2023.

This survey has been conducted since the 2008/2009 financial year. The survey is undertaken to understand the experience visa applicants have when receiving immigration advice from licensed immigration advisers.

The results for the 2020/2021 survey

The survey is managed by Gravitas OPG (an independent research company) on behalf of the Immigration Advisers Authority. The survey is undertaken using an online methodology. A random sample of applicants who have received a decision on their application and recorded by Immigration New Zealand as having used a licensed adviser (and with a personal email addresses on record) are invited to participate. The questionnaire is provided in English and Simplified Chinese.

If you are contacted by a client about the survey, please reassure them that the survey is genuine and that their participation would be greatly appreciated. If you have any further questions about the survey, you may contact MBIEresearch.survey@mbie.govt.nz